The Stephen G. Breyer Community Learning Center on Courts and the Constitution, which officially opened on March 25, offers civics education activities for learners of all ages and backgrounds throughout the First Circuit.

Judiciary News – United States Courts… Read the rest

The Make America Healthy Again (MAHA) Commission Report addresses food safety and its impact on chronic childhood illnesses in the United States.

Commissioned by President Donald Trump via executive order on Feb.13, the 14-member panel, chaired by Health and Human Services Secretary Robert F. Kennedy Jr., includes federal officials such as the USDA secretary and FDA commissioner. The report links food additives, pesticides and ultra-processed foods to conditions like obesity, diabetes and ADHD, urging stricter oversight and a shift to … Read the rest

The SEC Division of Trading and Markets (the Division) updated FAQs clarifying broker-dealer obligations and regulatory considerations for crypto asset activities and distributed ledger technology. The Division and FINRA’s Office of General Counsel also withdrew a 2019 Joint Statement regarding broker-dealer custody of digital asset securities.

The full update can be found here on our US Regulatory Intelligence platform.

Tasmanian Family Provision Claims

In Tasmania, the Testator’s Family Maintenance Act 1912 provides that specific family members can make a “family provision claim” from the estate if the deceased lived in and owned real estate in Tasmania at the date of death, the applicant believes the deceased’s Will does not adequately provide for their proper maintenance and support. Typically, the applicant must submit a claim within three months following the grant of probate.

An application for provision out of the … Read the rest

Two federal judges told Congress that the Judiciary has been negatively affected by two straight years of flat funding in most accounts, and they said a 9.3 percent increase in appropriations for the upcoming fiscal year is needed to ensure that the Judiciary can perform its essential constitutional functions.

Judiciary News – United States Courts… Read the rest

Authored by: Guan Feng (James) , Zhao Guannan and Huang Yabing

Amid growing global complexity and instability, China enacted the Anti-Foreign Sanctions Law (AFSL) in 2021, providing a legal framework for countering undue foreign sanctions. Following four years of deliberation, the State Council introduced the Regulations on the Implementation of the Anti-Foreign Sanctions Law (New Regulations) on 23 March 2025, refining operational rules and strengthening enforceability. This article provides a practical analysis of the key aspects of the New Regulations … Read the rest

Fresno Criminal Lawyer

Fresno Criminal Lawyer – Criminal Defense Lawyer Rick Horowitz

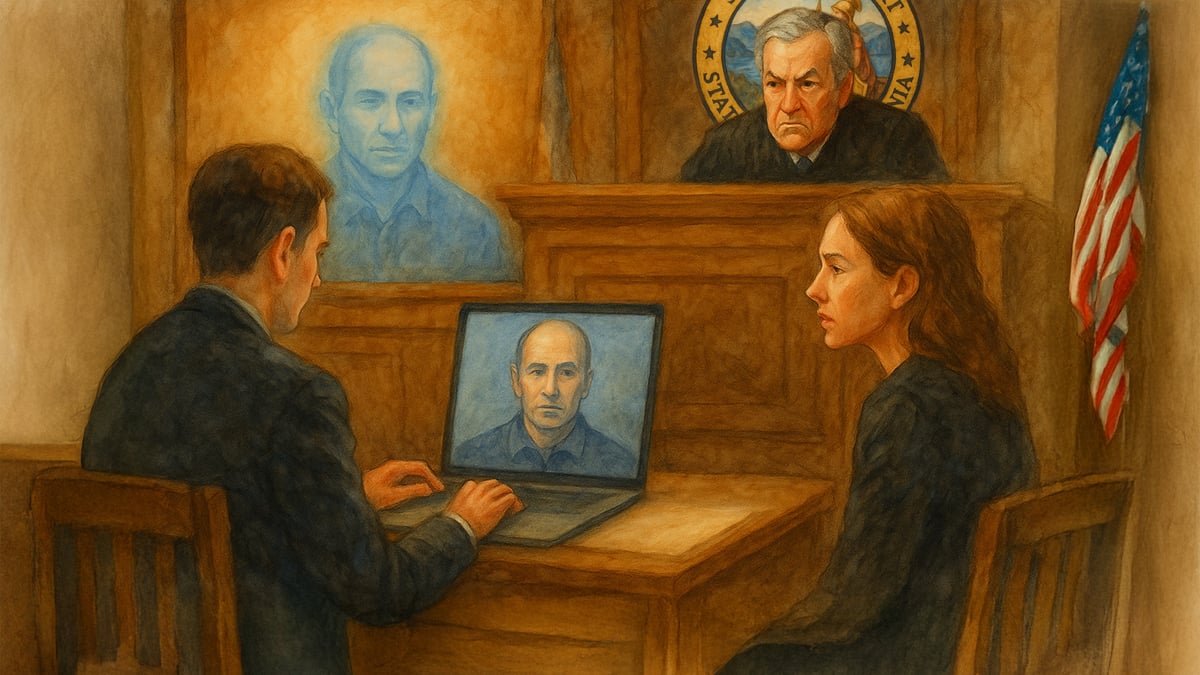

If you’ve read any of my other posts on AI, you know my key concern with it: confabulations cause hallucinations.

Case in point — and I’ll come back to this later — the other day I ran across an article about a dead man “coming to court” to give a victim impact statement regarding his own murder. I sent it to a couple of friends, including Scott Greenfield, … Read the rest

“Curiosity killed the cat” is a proverb “used to warn of the dangers of unnecessary investigation or experimentation” (Wikipedia) or is an idiom “said to warn someone not to ask too many questions about something” (Cambridge online dictionary). Yet for the modern officer, curiosity is a must, as it aligns with their personal WHS due diligence obligation.

Work health and safety (WHS) legislation, case law developments and many a published article on corporate governance (or lack thereof), confirm that in … Read the rest