Guest Post: The State of ERISA Fiduciary Litigation in 2025

In the following guest post, Justin Bove, Chief Revenue Officer and Fiduciary Lead at Encore Fiduciary, reviews and analyses the ERISA fiduciary class action lawsuits filed in 2025. A version of this article previously was published on Encore’s Fid Guru Blog (here). My thanks to Justin for allowing me to publish his article on this site. Here is Justin’s article.

*******************

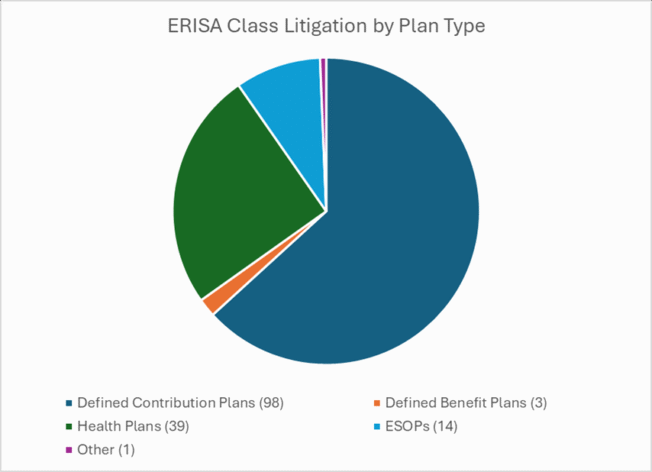

2025 saw a near-record high 155 fiduciary class lawsuits filed by plaintiff firms alleging violations of ERISA and breaches of fiduciary duty. With the help of the Dorsey & Whitney law firm, Encore Fiduciary tracked these lawsuits which revealed that companies sponsoring ERISA plans continue to be under attack by plaintiff firms.

- 401(k) plans remained the most frequent target:

- as in prior years, most lawsuits alleged excessive recordkeeping and/or investment fees

- many lawsuits specifically cited plan fees could have been reduced by the application of forfeitures to offset administrative expenses

- lawsuits that alleged imprudent investments shifted focus from the suite of target date funds (typically the QDIA in the plan) to stable value funds

- Health plans were targeted with increased frequency

- most frequent lawsuits alleged unfair premium surcharges on tobacco users without a reasonable alternative standard to earn the ‘full reward’

- voluntary benefit plans were targeted, raising concerns about the DOL’s safe harbor exempting most voluntary benefit programs from ERISA standards

By expanding their allegations against ERISA plans, plaintiff firms unlocked the ability to sue individual plan sponsors, and sometimes individual plans, multiple times. We counted over a dozen companies that faced multiple class ERISA lawsuits over the past two years, some by the same plaintiff firm. We share our analysis of ERISA litigation below to highlight its unfairness to the plan sponsor community, and its impact on the fiduciary liability insurance market.

Defined Contribution Plan Litigation Analysis

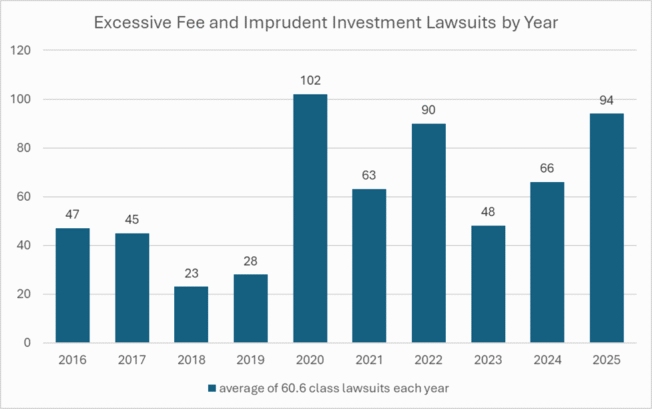

The chart below illustrates that more than 600 excessive fee and imprudent investment lawsuits have been filed against ERISA defined contribution plans over the last ten years, not counting Employee Stock Ownership Plans (ESOPs) which we have tracked separately.

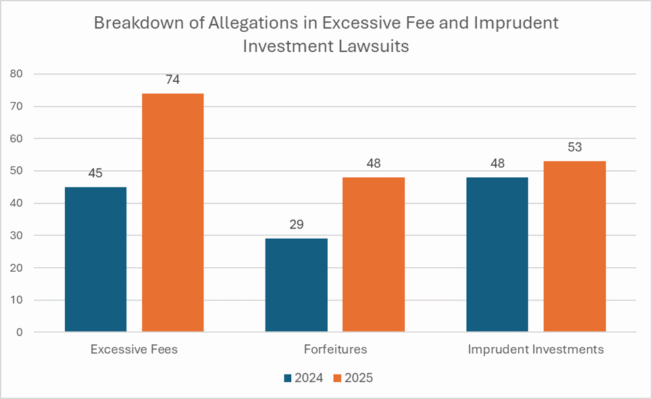

Excessive Fee Allegations

Excessive fee lawsuits contain, individually or in some combination, the following allegations: (1) plan recordkeeping fees or investment fees are too high, (2) plan forfeitures should have been used to offset plan expenses instead of offsetting future employer contributions, and/or (3) plan investment performance is lower than alternative options.

Key reasons why excessive fee lawsuits remain concerning:

- Both recordkeeping fees and investment fees have declined during the past ten years, yet during that same time lawsuits alleging excessive fees have increased significantly. Encore’s Large Plan Recordkeeping Benchmark Study proved that recordkeeping fees for large plans are already low, and more recently, the 25th Edition of the 401k Averages Book confirmed “a continuation of a long-running industry trend: both investment and recordkeeping fees are steadily declining,” and that “average investment-related fees decreased across all plan sizes… reinforcing the long-term trend toward lower participant costs.” [1] Plan fees have declined over the prior ten years, so it should correspondingly follow that the number of excessive fee lawsuits would also decline. Instead, the opposite has happened – plaintiff firms have filed more excessive fee lawsuits during the same time period during which plan fees have declined. This dichotomy proves that plaintiff firms sue plans with low fees, and their agenda has nothing to do with actual plan fees charged to plan participants.

- According to the BrightScope/ICI Defined Contribution Plan Profile published in March 2025, there were more than 1,500 401(k) Plans with more than $ 500m plan assets (what we consider to be ‘large plans’) in the 2022 fiscal year. Factoring in room for plan asset growth over the last three years and hedging that some of the 606 lawsuits over this period have targeted some plans more than once, we can still conservatively estimate that close to 25% of ‘large plans’ have been sued in the past ten years and have had to defend themselves against allegations of excessive fees and/or investment performance. This number is astronomically high when compared to the intended purpose of ERISA – a law of process not outcome, where Monday Morning Quarterbacking should not be permitted by the courts. Given that less than 3% of the universe of defined contribution plans are considered large plans [2], it is interesting to highlight that almost all the lawsuit activity within the last 10 years has targeted this 3%. It is even more interesting when you consider that large plans have significantly lower fees than small plans, as evidenced by the 401k Averages Book. Plans with the highest fees almost never face an excessive fee lawsuit, while plaintiff firms target the 3% universe of plans with the lowest fees charged to participants. Plaintiff firms can leverage higher settlements from larger plans, which is why they continue to be targeted over smaller plans.

Forfeiture Allegations

Forfeitures – unvested portions of employer-contributed amounts that an employee leaves behind without meeting the plan’s vesting requirements – have become part of plaintiff allegations in excessive fee lawsuits in recent years. Plaintiffs allege that forfeitures should be used to offset plan administrative fees, including those charged to individual accounts, rather than the standard industry practice of using unvested employer contributions to reduce future company matching contributions owed to a plan. While most courts have dismissed these cases at the initial motion to dismiss stage, the majority of dismissed cases have been appealed, pushing appellate courts to again scrutinize these allegations. Notably, the U.S. Department of Labor (DOL) submitted an amicus brief in Hutchins v. HP [3], in which it sided with the defendant and cited how a ruling in favor of the plaintiffs could ultimately harm plan participants. The DOL’s amicus brief seemingly did not phase plaintiff firms, who filed 21 of the 48 lawsuits with forfeiture allegations after the DOL’s amicus brief was submitted, and who subsequently still obtained a near $ 10m settlement in Singh v. Capital One Financial Corporation. [4] While the DOL’s position is a welcome development for plan sponsors and fiduciary insurers, its ultimate impact remains unclear until the Appellate Court’s ruling of the case.

Imprudent Investment Allegations Targeting Stable Value Funds

Allegations of imprudent investments remained high in 2025, with plaintiff firms shifting their focus from actively managed target date funds (which are more expensive than passive, index target date funds) to stable value funds. 27 lawsuits were filed challenging the inclusion of stable value funds, alleging they had crediting rates lower than other alternative fixed income investments available in the market. These lawsuits are still making their way through the courts, making it difficult to predict how successful these suits will ultimately be.

Alternative Assets in Retirement Plans

The Executive Order “Democratizing Access to Alternative Assets for 401(k) Investors” was signed on August 7, 2025, which provided 180 days for the DOL and other federal agencies to provide guidance for alternative asset investments to be included in retirement plans, including the potential to establish a safe harbor to protect plan sponsors from “litigation risk.” As of February 3, 2026, it remains unclear what this guidance may be. It also remains unclear if any potential regulatory safe harbor can curb litigation. Plaintiff firms have sued retirement plans with remarkable success over the past ten years, and are likely eager to sue retirement plans that replace transparent, low-cost investments with less transparent, higher-cost investments as part of any evolving investment strategy.

Health Plan Litigation Analysis

Class litigation against health plans has increased in frequency since the Consolidated Appropriations Act of 2021, which included provisions to increase fee disclosure requirements from service providers to health plans. As health plan fees are scrutinized more by plan participants and plaintiff firms, we anticipate increased legal activity against health plans.

Excessive Prescription Drug Cost Allegations

At the beginning of 2024, it was forecasted that excessive fee allegations targeting the cost of prescription drugs in health plans would become the next wave of ERISA litigation. Two cases filed in 2024 are still making their way through the courts. Both cases were initially dismissed due to lack of standing, but plaintiffs have amended their complaints, and in Lewandowksi v. Johnson & Johnson appealed to the Third Circuit. [5] Accordingly, only one such lawsuit was filed in 2025, albeit with slightly different allegations to secure standing. If a roadmap is determined which secures standing in these cases, then there may be additional lawsuits filed. In the meantime, some plan sponsors have proactively sued their pharmacy benefits managers (PBMs) alleging a lack of transparency and for unfairly driving up prescription drug prices. PBMs have also been increasingly scrutinized by regulatory agencies with similar concerns, which has likely stalled this legal theory.

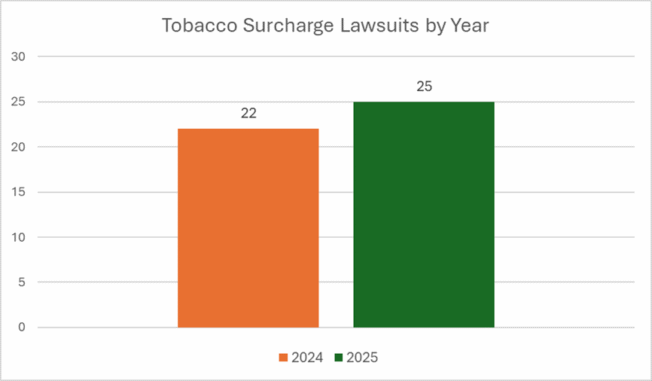

Tobacco Surcharge Allegations

In these lawsuits, plaintiffs allege that plans have imposed premium surcharges to tobacco users in violation of ERISA and non-discrimination rules under HIPAA, and/or that wellness incentive programs which offer a reasonable alternative standard to earn or recoup the ‘full reward’ are not in compliance with federal law. Prior to 2024, one tobacco surcharge lawsuit was brought by the DOL, and within two weeks of bringing suit a judgement of less than $ 150k was rendered. [6] In 2024 and 2025, almost 50 such lawsuits were filed, 30 by one plaintiff firm, with multiple settlements just under $ 5m. [7]

More than ten cases have received rulings on motion-to-dismiss, and only case was fully dismissed. Courts have ruled in favor of the plaintiffs in all other cases, allowing the suits to proceed partially or fully. The one case which was fully dismissed, Williams v. Bally’s Management Group, has subsequently been appealed. [8] Given the success rate in courts, and the quick and high settlements obtained in these cases, tobacco surcharge lawsuits seem likely to be the main fiduciary claim trend to watch in 2026.

Ghost Network Allegations

One class lawsuit, Hecht v. Cigna, saw significant development in 2025 that bears monitoring. Originally filed in 2024, the lawsuit alleged that Cigna breached its fiduciary duty and violated ERISA by failing to monitor its provider network, creating a ‘ghost network’ which inaccurately represented out-of-network providers as being in-network. While previously thought to be an administrative function, in February 2025 the breach of fiduciary duty allegation survived the motion to dismiss. The court ruled that “repeated and systematic failures” by Cigna were sufficient to “plausibly suggest a breach of ERISA’s duties of loyalty and prudence.” [9] By October, the parties announced a settlement agreement for almost $ 6m. [10] This ruling impacts plan sponsors significantly, as the ERISA violation exposes the potential for equitable relief under Section 502(a)(3), which many fiduciary carriers do not affirmatively cover.

Voluntary Benefits Allegations

On December 23, 2025, one plaintiff law firm filed four class lawsuits in two different district courts which targeted voluntary benefit plans, alleging breaches of fiduciary duty by employers for failing to monitor the commissions earned by their benefits consultants. Interestingly, the lawsuits named these benefits consultants as defendants as well, alleging they acted in a fiduciary capacity rather than merely as a service provider. The lawsuits are one of many filed following the Supreme Court’s ruling in Cunningham v. Cornell where plaintiff firms anticipate a lower bar to survive a motion to dismiss by alleging a prohibited transaction occurred. The DOL has established a safe harbor for voluntary benefits, exempting them from ERISA requirements if certain conditions are met. It is noteworthy that all four lawsuits allege the employers failed to comply with the DOL’s safe harbor, in part by filing Form 5500s with respect to each plan. These cases will be closely monitored to see if additional lawsuits will be filed, and if so, how allegations relate to compliance with the DOL’s safe harbor.

Defined Benefit Plan Litigation Analysis

Pension Risk Transfer Allegations

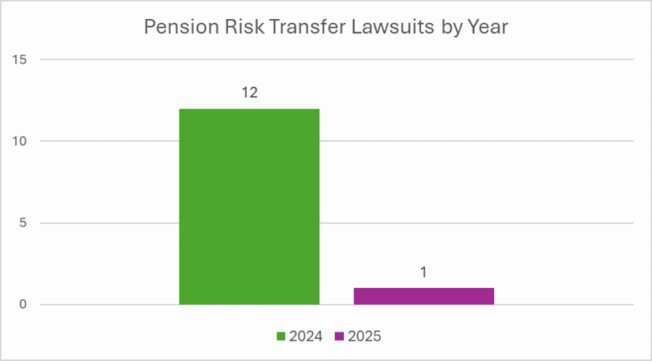

Since the beginning of 2014, 13 class lawsuits have been filed against employers who had previously transferred assets and liabilities from their pension plans to purchase a group annuity contract from an insurance company, through a pension risk transfer (PRT) transaction. Plaintiff firms alleged this offloading of pension obligations to private insurance companies violated ERISA by not selecting the “safest available annuity” for retirees. Of the 13 PRT lawsuits filed to-date, 11 targeted insurer Athene and two targeted insurer Prudential. The main development in this space has been the split court rulings:

- 10 lawsuits remain from the original 13 filed, since three pairs were filed against the same defendants.

- 4 out of 10 were dismissed, but in three out of the four cases plaintiffs have either filed an amended complaint or filed a motion to alter the judgment and for leave to file an amended complaint. The fourth case was dismissed in early January 2026, and plaintiffs will likely file a motion to alter the judgement or appeal the dismissal.

- 2 out of 10 were denied motions to dismiss.

- 4 out of the 10 have yet to obtain court rulings on the initial motion to dismiss.

Split court rulings are likely to incentivize plaintiff firms to file similar cases, since only a few need to be successful to leverage settlements.

Actuarial Equivalence Allegations

Just one new lawsuit was filed in 2025 alleging that plan sponsors relied on outdated mortality tables, and therefore underpaid benefits to retirees who elected to receive lump sum benefits or to married participants when converting single-life annuities to joint and survivor annuities. Fiduciaries have followed their plan documents in these cases, yet most courts have continued to deny motions to dismiss, calling into question whether ERISA has an implied ‘reasonableness’ requirement that mortality tables be ‘current’ and not ‘outdated.’

ESOP Litigation Analysis

In 2025 there were 14 class lawsuits targeting ESOPs, all containing an allegation of improper valuation of company stock or insider benefit from a transaction. There were also 11 settlements of ESOP lawsuits in 2025, ranging from $ 450k to $ 84m. At his confirmation hearing before the Senate Health, Education, Labor and Pensions (HELP) Committee in June 2025, Dan Aronowtiz, now the Assistant Secretary of Labor for the Employee Benefits Security Administration (EBSA), stated he would “end the war on ESOPs” – a comment which received bipartisan support. In January 2026, EBSA announced its national enforcement projects for the 2026 fiscal year, in which it was confirmed ESOPs are “removed from the national enforcement project list.” [11]

Conclusion

Of the 600+ excessive fee lawsuits filed against ERISA plans over this ten-year period, very few ever make it to trial. Based on our internal database, 60-65% have survived the motion-to-dismiss phase, at which point plan sponsors and fiduciary insurers are faced with spending millions of dollars to produce documents in discovery and proceed toward trial. At this stage, plaintiff firms use this leverage to procure high settlements, as their case load does not permit them to try all of these cases even if they wanted to do so, which they don’t.

2025 Settlement Data:

In 2025, we tracked over 30 settlements of excessive fee and imprudent investment lawsuits, with an average settlement of just over $ 3m when removing the largest outlier ($ 69m settlement of Snyder v. UnitedHealth Group). [12] As discussed earlier, the average settlement for tobacco surcharge litigation was even higher at almost $ 5m.

Our internal data indicates that in the last five years, there have been over 200 settlements of excessive fee and imprudent investment lawsuits totaling more than $ 1.3b.

Plaintiff law firms typically get 33% of these settlements, which calculates to almost $ 450m during this time period.

Based on our calculations and combined with analysis from the Davis & Harman law firm, it appears that individual plan participants each obtain only $ 55-70 on average from these same settlements. [13]

Plaintiff firms have even gone on the record stating their goal is to survive the motion to dismiss, as one leading plaintiff firm was cited recently by Bloomberg saying “We don’t know… So we made the claim and then we will see if we can survive the motion to dismiss.” [14]

Fiduciary class litigation will only slow down if plaintiff firms lose the ability to leverage high settlements and can no longer significantly profit from filing so many cases against ERISA plan sponsors. It does not appear that legislative change is likely, as we recently wrote in our article “Congressional Hearing on ERISA Litigation: Bipartisan Support Is Needed to Set a Higher Pleading Standard.”

It does appear that regulatory change is beginning to happen. As noted above, the DOL filed an amicus brief in a forfeiture case in which it sided not with the plaintiffs but with the defendants. In January 2026, the DOL filed similar amicus briefs in three additional forfeiture cases and in a pension risk transfer case. [15] A reading of these briefs reveals the DOL’s thoughtful approach shifting from a ‘pro-plaintiff’ focus to a ‘pro-system’ focus, siding against plaintiffs in individual cases to concentrate on the bigger picture to ensure that employers can continue to provide good retirement and health benefits to employees without the threat of being sued.

In the current litigation environment, plaintiff firms file as many lawsuits as possible with the same allegations in district courts across the country. They sue plans with good fiduciary processes and low fees as part of their business model, taking advantage of court rulings against ERISA fiduciaries to leverage high settlements. These frivolous lawsuits have impacted fiduciary insurers’ ability to determine a good risk from a bad risk, even when reviewing fiduciary processes, investment lineups, plan documents, and fee levels. The fiduciary liability insurance market will remain in a hardened state, with high class retentions and high premiums, as long as this is the case.

Notes

Encore Fiduciary is a leading insurer of fiduciary liability insurance for all types of employee benefit plans throughout the country, including public companies, private and not-for-profit companies, governmental retirement systems, multiemployer plans, pooled employer plans, and ESOPs. Encore also writes management liability insurance – Directors & Officers Liability, Employment Practices Liability, and Crime Coverage – for private and not-for-profit risks.

Encore publishes articles regularly on its Fid Guru Blog, which provides fiduciary thought leadership, educational content, and advocacy for plan sponsors.

Justin Bove is the Chief Revenue Officer and Fiduciary Lead for Encore. He can be reached at jbove@encorefiduciary.com.

Footnotes

[1] “25th 401k Averages Book: Plan Fees Still Declining” by Brian Anderson

[2] BrightScope/ICI Defined Contribution Plan Profile

[3] Brief for the U.S. Secretary of Labor as Amicus Curiae Supporting Defendant-Appellee

[4] PACER Docket for Case 1:24-cv-08538

[5] PACER Docket for Case 3:24-cv-00671

[6] PACER Docket for Case 1:23-cv-06583

[7] PACER Dockets for Cases 3:24-cv-00686 and 6:24-cv-03122

[8] PACER Docket for Case 1:25-cv-02058

[9] “Ghost Networks, ERISA Fiduciary Duty, and the Future of Provider Directory Litigation” by Naga Vivekanadan

[10] “Cigna Reaches Class Settlement Over Provider List Coding Error” by Jacklyn Wille

[11] US DOL EBSA Updates National Enforcement Projects for Employee Benefit Plans

[12] PACER Docket for Case 0:21-cv-01049

[13] Davis & Harman LLP 2025 Underperformance and Excessive Fee Settlement Survey

[14] “Bloomberg Sued Over 401(k) Plan Funds That Allegedly Lagged Market” by James Van Bramer

[15] Amicus Curiae Brief of the U.S. Secretary of Labor in Support of the Appellant and Reversal